Restricted Liquidity: A lot of the alternative assets that could be held within an SDIRA, including real estate property, non-public fairness, or precious metals, is probably not quickly liquidated. This may be an issue if you'll want to access money swiftly.

And since some SDIRAs like self-directed regular IRAs are subject to necessary least distributions (RMDs), you’ll must approach in advance making sure that you have enough liquidity to meet the rules set through the IRS.

Increased Expenses: SDIRAs generally include bigger administrative costs in comparison to other IRAs, as sure areas of the administrative procedure can not be automated.

Complexity and Accountability: By having an SDIRA, you have got extra control more than your investments, but Additionally you bear much more duty.

This involves knowledge IRS restrictions, taking care of investments, and averting prohibited transactions that can disqualify your IRA. An absence of knowledge could bring about highly-priced faults.

Entrust can aid you in obtaining alternative investments with all your retirement resources, and administer the obtaining and selling of assets that are generally unavailable by way of banking institutions and brokerage firms.

Consider your friend may very well be starting the following Fb or Uber? With an SDIRA, it is possible to spend money on leads to that you think in; and likely appreciate increased returns.

Be answerable for how you grow your retirement portfolio by utilizing your specialised expertise and interests to take a position in assets that match with all your values. Acquired expertise in real estate property or private equity? Utilize it to assist your retirement planning.

Earning quite possibly the most of tax-advantaged accounts allows you to maintain much more of The cash that you choose to spend and receive. According to no matter whether you select a standard self-directed IRA or possibly a self-directed Roth IRA, you've got the possible for tax-no cost or tax-deferred expansion, furnished specific disorders are satisfied.

As you’ve found an SDIRA supplier and opened your account, you might be wanting to know how to really get started investing. Comprehending equally The principles that govern SDIRAs, together with ways to fund your account, can help to put the muse for just a way forward for thriving investing.

Should you’re seeking a ‘set and fail to remember’ investing approach, an SDIRA probably isn’t the correct decision. Because you are in total Regulate over each investment built, It really is your choice Read Full Report to execute your personal research. Don't forget, SDIRA custodians are not fiduciaries and can't make tips about investments.

In contrast to shares and bonds, alternative assets tend to be more difficult to market or can have rigorous contracts and schedules.

Real estate property is one of the most popular choices among the SDIRA holders. That’s simply because you may invest in any sort of real-estate with a self-directed IRA.

SDIRAs are sometimes utilized by palms-on buyers who are ready to tackle the pitfalls and duties of selecting and vetting their investments. Self directed IRA accounts can also be great for investors that have specialised knowledge in a niche current market which they would want to spend money on.

No, You can not spend money on your own personal business by using a self-directed IRA. The IRS prohibits any transactions involving your IRA along with your personal business enterprise since you, as the operator, are deemed a disqualified particular person.

Range of Investment Solutions: Ensure the company lets the categories of alternative investments you’re serious about, for instance property, precious metals, or non-public equity.

Better investment selections suggests you could diversify your portfolio past stocks, bonds, and mutual cash and hedge your portfolio against marketplace fluctuations and volatility.

Many traders are amazed to understand that employing retirement money to speculate in alternative assets has actually been doable due to the fact 1974. Nonetheless, most brokerage firms and financial institutions deal with supplying publicly traded securities, look these up like stocks and bonds, as they deficiency the infrastructure and expertise to i loved this deal with privately held assets, like housing or personal fairness.

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the purpose of producing fraudulent investments. They usually idiot buyers by telling them that If your investment is acknowledged by a self-directed IRA custodian, it need to be authentic, which isn’t accurate. Again, make sure to do complete homework on all investments you select.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Romeo Miller Then & Now!

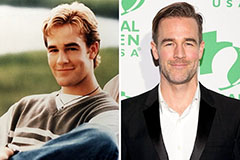

Romeo Miller Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Batista Then & Now!

Batista Then & Now!